In the whirlwind world of sports, where athleticism meets business acumen, occasionally there lies a tale that reads much like a crime thriller. The story of Shohei Ohtani’s former interpreter, Ippei Mizuhara, offers a plot fit for a gripping novel—a trusted advisor gone rogue, an eye-watering $17 million fraud, and a dramatic fall from grace. This tale, however, is less fiction and more the reality for Major League Baseball and one of its brightest stars, Shohei Ohtani.

Mizuhara, once a pillar of Ohtani’s close-knit circle, has found himself on the wrong side of the law, now facing a 57-month stint in federal prison. The charges? Bank and tax fraud so audacious they almost seem implausible. Mizuhara’s devious deeds unraveled through a series of cunning maneuvers: altering banking protocols, impersonating the very individual he was supposed to serve, and draining Ohtani’s accounts to the tune of millions. The culmination of this betrayal arrived in June 2024 when Mizuhara entered his guilty plea, unraveling his intricate web of deceit linked to a spiraling gambling addiction that ensnared him in its unrelenting grasp.

Rewinding to March 2024, the scandal’s initial flicker sparked into a full-blown blaze when ESPN’s investigative reporting pulled back the curtain on Mizuhara’s illicit activities. The alarming news led to his immediate dismissal from employment with the Los Angeles Dodgers, painting a vivid picture of trust shattered like glass. The federal authorities, with investigative prowess akin to a CSI episode, descended into a thorough examination of Mizuhara’s fiscal fiasco, revealing a series of alarming transactions authorized by nothing more than bravado and impersonation.

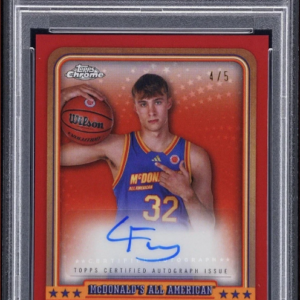

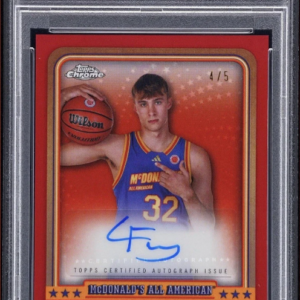

In the courtroom, it emerged that Mizuhara played his part as an impostor with aplomb, granting himself access to Ohtani’s finances—like a magician with a wand carelessly waived over bank accounts. The funds, rerouted with nefarious intent, covered gambling debts and luxurious personal expenses that Mizuhara could ill-afford. A peculiar subplot surfaced—some of these purloined funds were transformed into an eclectic collection of sports cards, an investment gone awry in hobbyist roulette.

These coveted sports treasures, flaunting the likes of Ohtani, Yogi Berra, and the promising Juan Soto, were purchased through online marketplaces such as eBay and Whatnot. Mizuhara, apparently not discerning enough to win at either legitimate or illicit practices, intended to profit from these endeavors. His artful dodging, however, was met with legal justice. By November 2024, Ohtani, perhaps sipping tea rather than engaging in the uproar, petitioned the federal courts to reclaim these tangible remnants of betrayal—a request swiftly granted in a December ruling favoring the star athlete.

Justice, like the game of baseball, comes with a rigorous set of rules and penalties steep enough to forge a cautionary fable. Mizuhara now faces an extended time-out in federal prison, mandated to repay a staggering $17 million to Ohtani—a restitution that reconstructs financial fences previously dismantled by his deceit. Moreover, the IRS demands an additional $1.1 million to square up on unpaid taxes. As Mizuhara grapples with the consequences, a three-year supervised release waits in the wings post-incarceration. Additionally, deportation looms as a possibility for the Japanese national, a reality check so sobering it could cure any adventurous gambler of his vices.

The ramifications of this financial saga reverberate well beyond the courtroom. The Ohtani-Mizuhara conundrum casts a long shadow over Major League Baseball and the sports industry at large, igniting conversations about financial safeguards and the vulnerabilities of high-profile sports figures. Ohtani, known for letting his bat and pitching arm do the talking rather than engaging in public frays, remains reticent on the matter. Yet, this incident underscores the critical importance of financial vigilance and the potential pitfalls that accompany fame and fortune.

As one chapter closes with Mizuhara’s sentencing, the aftershocks of this high-stakes fraud continue to rumble through the sports industry. Collectors and athletes alike ponder the lessons from this saga, aware that even those to whom they entrust their fortunes might harbor ulterior motives. Misplaced faith, like an errant baseball, sometimes lands in unexpected places, but Mizuhara’s tale serves as a yardstick of caution—a stark reminder that in the game of life as in baseball, the devil is in the details and trust must be safeguarded with the vigilance of an outfielder watching for a fly ball.