In a world where the value of a single sports card can rival that of a small car, Canadian collectors have not had much in the way of specific insurance to cover their prized possessions. That has changed with the unveiling of a new insurance program designed specifically for sports card and memorabilia enthusiasts. This initiative is a collaborative effort between NFP, a leading property and casualty broker in the nation, and Berkley Asset Protection, a specialist in insuring fine collectibles. Together, they’re stepping up to the plate to offer a solution for an underserved market.

The genesis of this specialized insurance program came from the realization of a significant coverage gap under standard homeowners insurance policies, which usually fall short when it comes to high-value collectibles. Greg Dunn, Managing Director of Personal Risk at NFP in Canada, highlighted the vital nature of this insurance for collectors embarking on significant acquisitions. With the launch of this initiative, collectors will find comfort in a product crafted to shield their investments from theft, damage, or other loss from the moment they make a purchase.

What makes this program different from general insurance plans is its attention to the specific needs of sports memorabilia collectors. It caters to both seasoned collectors who possess extensive and invaluable collections, and the novices just starting their journey in the collectible world. Olivia Cinqmars-Viau, AVP of fine art underwriting at Berkley Asset Protection, delineated the tailored nature of this program. It includes automatic coverage for new acquisitions, meaning that new items are protected as soon as they are added to a collection. Additionally, there’s a cardinal feature of transit coverage, safeguarding items as they move from one location to another—a frequent necessity in the world of collectors.

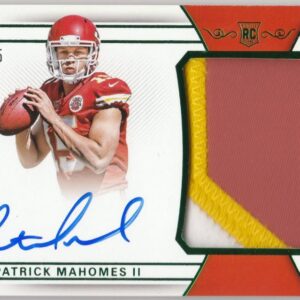

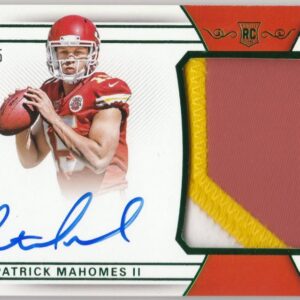

The necessity of such specialized insurance is clear. While many collectors treat their memorabilia as mementos first and investments second, the financial value cannot be overlooked. Items once bought for mere cents at garage sales or decades-old game days can now fetch thousands, if not millions, in today’s frenzied market. Steve Menzie, president and owner of the Sport Card & Memorabilia Expo—the largest sports collectibles exposition in Canada—underscored the practicality of this insurance. As a veteran in the field, he knows well the dual nature of these collections: deeply personal yet financially substantial.

For those interested in learning more or even securing this innovative coverage, NFP’s Personal Risk team will not be hard to find. They are set to host a booth at the upcoming Sport Card & Memorabilia Expo in Toronto, happening from April 25-28. There, collectors can inquire about the nuances of the insurance, determine its fit with their collections, and perhaps leave a bit more secured than they arrived.

This novel insurance initiative is part of a broader strategy by NFP to cater to niche markets and unique client needs. With over 1,000 staff in Canada and more than 8,500 around the globe, their focus on customized solutions in the personal risk sector is becoming a company hallmark, much to the benefit of collectors and enthusiasts in various specialties. As the landscape of sports memorabilia continues to grow—both in number of collectors and in the value of collections—having a tailored insurance solution such as this could well be a game-changer in the industry, protecting the past and future of sports history one policy at a time.