Beckett Grading Services, a once prominent name in sports card grading, finds itself in troubled waters as it navigates a significant downturn in its business operations. The latest data from grading analytics platform GemRate paints a grim picture for the company, with only 32,000 cards graded in November, marking a sharp 32% decrease from the previous month and a staggering 43% decline year-over-year. This decline highlights a concerning trend for Beckett, which had seen a more modest 13% drop in August.

The challenges facing Beckett have been exacerbated by the legal issues surrounding Greg Lindberg, the owner of Beckett’s parent company. Lindberg’s involvement in a $2 billion insurance fraud scheme has further destabilized the already struggling grading company. Court filings have revealed financial mismanagement, including a $100 million loan secured against Beckett Grading Services, from which BGS reportedly received only $500,000. These revelations have cast a shadow of doubt on Beckett’s ability to recover, with the specter of liquidation looming as Lindberg’s assets face scrutiny.

The scandal surrounding Lindberg has not only raised concerns about Beckett’s financial stability but has also shaken collector confidence in the company. While the sports card grading industry is experiencing significant growth, Beckett has failed to capitalize on this upward trend. Among the “Big Four” grading companies, Beckett is the only one witnessing a decline, with competitors like PSA, SGC, and CGC Cards seeing notable increases in their grading volumes.

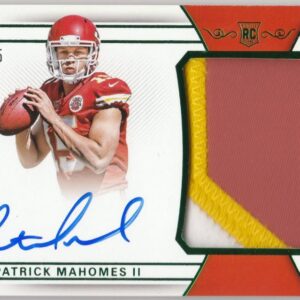

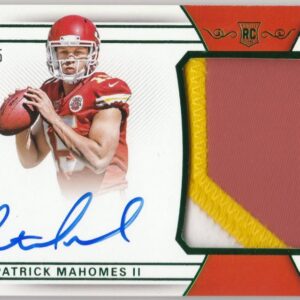

Beckett’s fall to fourth place among the leading grading companies has been particularly striking, with CGC surpassing Beckett in sports card grading in November. This shift in the ranking comes despite sports cards accounting for a significant portion of Beckett’s total volume. While Beckett’s Black Label 10s and Pristine 10s continue to command premiums in niche markets, the company’s high-volume grading has suffered, further compounded by the aggressive promotional strategies of its competitors.

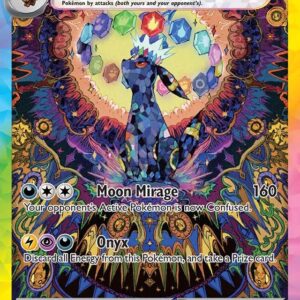

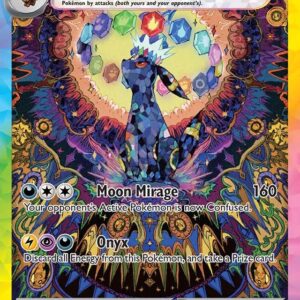

The decline in Beckett’s grading activity for iconic cards, such as the 1952 Mickey Mantle and the 1989 Upper Deck Ken Griffey Jr., underscores the broader trend of the company losing ground in areas where it once excelled. Despite its continued relevance in niches like high-end basketball cards, TCG grading, and Topps Now cards, Beckett faces an uphill battle as it struggles to adapt to the changing landscape of the grading industry.

As Beckett Grading Services confronts mounting challenges, from legal troubles to increased competition, the road ahead remains uncertain. While the company’s reputation for premium grades still holds value in specific markets, the overall decline in grading volume points to deeper systemic issues that need to be addressed. The question now arises: Will Beckett be able to pivot and regain its position in the industry, or will it continue on its downward trajectory? With collectors and industry observers closely monitoring its every move, the future of Beckett Grading hangs in the balance.